Utilizing a most-in-you to definitely ETF on the RRSP

Charge to your small account try various other basis to adopt before you can wade Doing it yourself. Bank-had brokerages usually fees $one hundred a year for the RRSPs you to wear’t meet its minimal account dimensions conditions—typically $15,one hundred thousand or $25,100, with regards to the broker. Particular may charge highest trading earnings if your equilibrium is actually lower than a particular endurance.

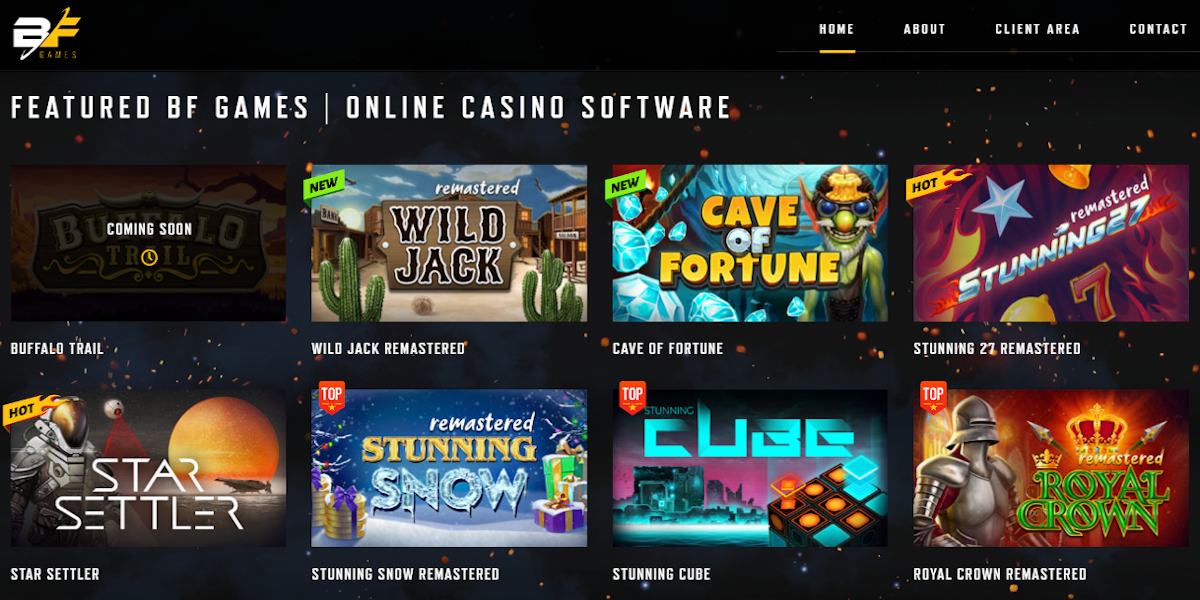

— Jim think a costly gym subscription might help inspire your to help you end being a couch potato because most of your exercise equipment is associated with tv sets. Do you imagine this is of your own couch potato idiom merely by the taking a look at the picture? A couch potato are a greatest expression within the American English very it is well worth studying. Understand the new conditions we used to assess position game, that has sets from RTPs to jackpots.

Keep in mind that this type of design portfolios were several different goals for holds and you will securities. Traditional investors will be spend some an elevated to express to help vogueplay.com you can find out more you bonds (which can be much safer) and less to help you stocks. Competitive traders takes far more chance by the allocating a high proportion so you can stocks. Very traders might possibly be better-served by a balanced collection of somewhere within 31% and you may 80% stocks.

- If you are here’s no be sure associated with the inverse relationships, it’s generally recognized you to definitely carrying stocks and you can bonds with her produces an excellent lower-chance profile.

- The overall game is designed such a means that it appears as the total package, while the records blue serves as a contrast facing all the warm tones that are put on display.

- Canadian Inactive can make a lot of higher suggestions for people that are looking to carry out their particular investment.

- We’lso are maybe not gonna build a visit for the rates of interest to the a preliminary-identity base, however, because of the checklist reduced rates, they actually just have one spot to wade, that is up.

- In such instances, anyone will get say such things as “he’s started a couch potato for too much time”, proving that they have to awake and commence moving around a lot more.

For those who’re investing $ten each time you get otherwise promote an ETF, you should wait until you have got at the very least $dos,100000 approximately prior to making a transaction. Let’s start by approaching the fear of losing the ability to decide which ETFs to market to fund the typical distributions. For individuals who keep multiple financing, it’s true, you might mix their withdrawal package along with your rebalancing strategy. Such as, if you want to withdraw $25,100 from the RRSP, you will want to find out and this investment category is really obese from the profile, and slim you to definitely holding. For many who’re also heavy holds, then you definitely is always to promote some holds in order to take back the brand new $twenty-five,one hundred thousand.

RSSY ETF Opinion – Return Loaded U.S. Holds & Futures Produce ETF

Those people members whom enjoyed the very thought of including loyal inflation-fighting assets was rewarded. I will note that the new inflation-attacking property—such as commodities, silver and you will commodity stocks—is almost certainly not necessary while you are regarding the accumulation phase, meaning your’re increase their collection. Over long symptoms from 15, twenty years or maybe more, stock places make a stunning rising prices hedge. In the old age, otherwise while we method the new senior years risk region, avoiding near-identity rising prices dangers is essential. 2nd, let’s go through the efficiency of the state-of-the-art inactive profiles during the certain risk membership.

Exercise dos: Part Gamble

Whenever Browne created the Permanent Collection on the mid-eighties, they wasn’t including very easy to do oneself. Browne recommended splitting your money similarly certainly one of stocks, long-label authorities ties, gold and cash. Many of these ETF profiles less than is Canadian stocks, All of us stocks, and you may global brings (from each other set up and you will emerging areas), providing greater experience of the global collateral field. He is well-balanced because of the an enthusiastic allocation to bonds to minimize volatility and you will chance. Finding the compatible blend of carries and ties is among the most important choice your’ll need to make. My associates Justin Bender and Shannon Bender have created an excellent videos to make this important choices.

Looking to make your individual Inactive portfolio having directory financing or ETFs? In the end, understand that code evolves through the years and definitions can alter. If you are “inactive” has been in existence for a couple years now, its usage can get move because the personal thinking for the spare time and you may efficiency still develop. Within the sets, take turns acting out situations where anyone has been a great “couch potato” plus the most other is trying to help you motivate these to awaken and you may do something productive. If an internet local casino generally seems to force a get you, it’s doubtful.

This era takes into account inception date on the ETF property offered. And the initiate date coincides to your beginning of rising cost of living anxieties during the early 2021. The newest Cutting edge collection ‘s the laggard, as the all-community ETF it offers ten% experience of emerging areas.

The view is that that on line casino slot games doesn’t offer almost adequate spins bonuses in order to guarantee a place to the any user’s set of preferred. When you’re you’ll find some people which will find the new free spins incentives as somewhat beneficial, we think that all people would be best off searching for almost every other online slots with increased lucrative extra have. Inactive money earnings made inside a company, concurrently, are taxed from the just one flat fee of around 50% within the Ontario, or nearby the high limited income tax rates. Couch potato income tax prices are very high as the Canada Money Agency (CRA) doesn’t wanted us to has an unjust taxation advantage from the spending the profiles into the companies. Register for CNBC’s on line course Ideas on how to Earn Inactive Income Online to know about common couch potato income streams, tips to get started and you can actual-lifestyle achievements tales.

Your butt Potato position is a great option for people searching to have a leading-quality on the internet slot machine game that have the lowest-risk basis. Withholding income tax away from you during the business height very first reaches the newest goal of eliminating any advantage you may have by increasing your investment capital inside company against. personally. In addition, it produces fairness for the reason that you are not twice taxed on that financing money when you take the money from your own firm because the a dividend. Provided this type of high cost, you could ask yourself if you should bring the bucks away of the holding organization and purchase they in person, particularly if your mediocre private income tax rates is leaner than simply fifty%. Rather, you might like to imagine using a secured asset-allowance ETF service. Such “all-in-one” ETFs come in various other stock/bond allocations to suit your chance choice, and they are worldwide diversified.

The fresh Canadian stock market did better overall, because of time and you will commodities exposure. All advantage are bad within the 2022, apart from the genuine resource financing. I have to acknowledge We questioned the difference inturn between these types of 2 portfolios as far higher. Remarkably, your butt Potato Portfolio hit less CAGR compared to the S&P five hundred, with around half of the new volatility, much quicker drawdowns, and much greater risk-modified get back (Sharpe).